How a leading French bank improved customer experience with Insurely.

Insurance has long been a maze of complexity, filled with jargon, fine print, and one-size-fits-all policies that don’t always meet individual needs. Traditionally, insurers and banks have relied on broad risk models, grouping customers into generalized categories that often fail to reflect their true risk profile. This is why one of the largest retail banks in France has decided to partner with Insurely to offer their customers a comprehensive insurance overview and comparison tool with the ability to craft more accurate, transparent, and personalized offers for their customers.

As a leader in the financial industry, this bank is dedicated to providing innovative insurance solutions that enhance transparency and customer confidence.

By leveraging real-time insurance data, with Insurelys Insurance Data Access, the solution we’ve built together empowers customers to better understand their home and car insurance coverage, compare policies with ease, and make more informed financial decisions.

The challenge: A missed opportunity.

One of the biggest challenges for one of the largest retail banks in France is ensuring that its customers recognize it not only as a banking institution but also as a trusted insurance provider.

Currently, a staggering 70% of its customers are unaware that they can purchase insurance through the bank, representing a significant missed opportunity. This lack of awareness directly impacts the bank's ability to grow its insurance business, as the ultimate goal is to increase policy sales and strengthen its position in the market. Overcoming this challenge requires a strategic approach to branding, communication, and customer engagement to seamlessly integrate insurance offerings into the broader banking experience.

The solution: Insurely’s Insurance Data Access.

To address these challenges, Insurely’s product Insurance Data Access comes in. Insurance Data Access has allowed the bank to develop a unified platform where customers can manage all their financial information, including insurance policies, in one place.

By offering data-driven insights, the bank empowers consumers to better understand their current insurance situation, supporting informed financial decision-making.

The result: A more informed and empowered customer experience.

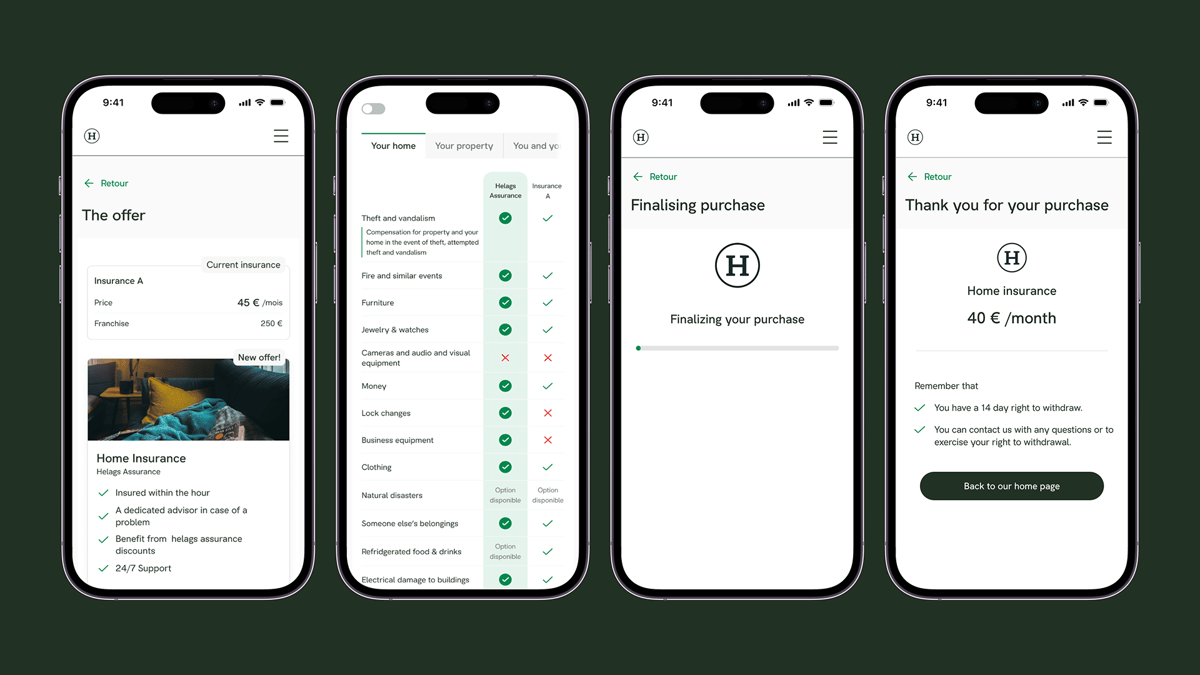

By providing a centralized platform where users can view all their insurance policies alongside their financial information, customers now have a more holistic and convenient way to manage their finances. This streamlined approach eliminates the hassle that customers face, of having to track multiple policies across different providers, offering a clearer understanding of their current coverage and what they’re paying for.

Beyond convenience, the tool empowers consumers with data-driven insights, helping them make informed financial decisions with greater confidence. By analyzing their existing insurance policies, customers receive personalized insights and comparisons that highlight potential gaps or cost-saving opportunities. This not only enhances financial literacy but also ensures that consumers are choosing policies that best suit their needs.

Additionally, the introduction of innovative features such as automated contract retrieval and an intuitive, easy-to-understand results display, has strengthened the bank’s reputation as a forward-thinking leader in financial services. Customers appreciate the transparency and simplicity, especially compared to more traditional insurance comparison methods. As a result, the tool has not only improved customer satisfaction but also reinforced the bank’s position as an innovator in the financial industry, offering solutions that truly cater to modern consumer needs.

Explore the journeys of our customers in France and Sweden by visiting Insurely's customer showcase.

Ready to learn how Insurance Data Access can transform your business? Get in touch with us.