Win-win experiences built by our clients.

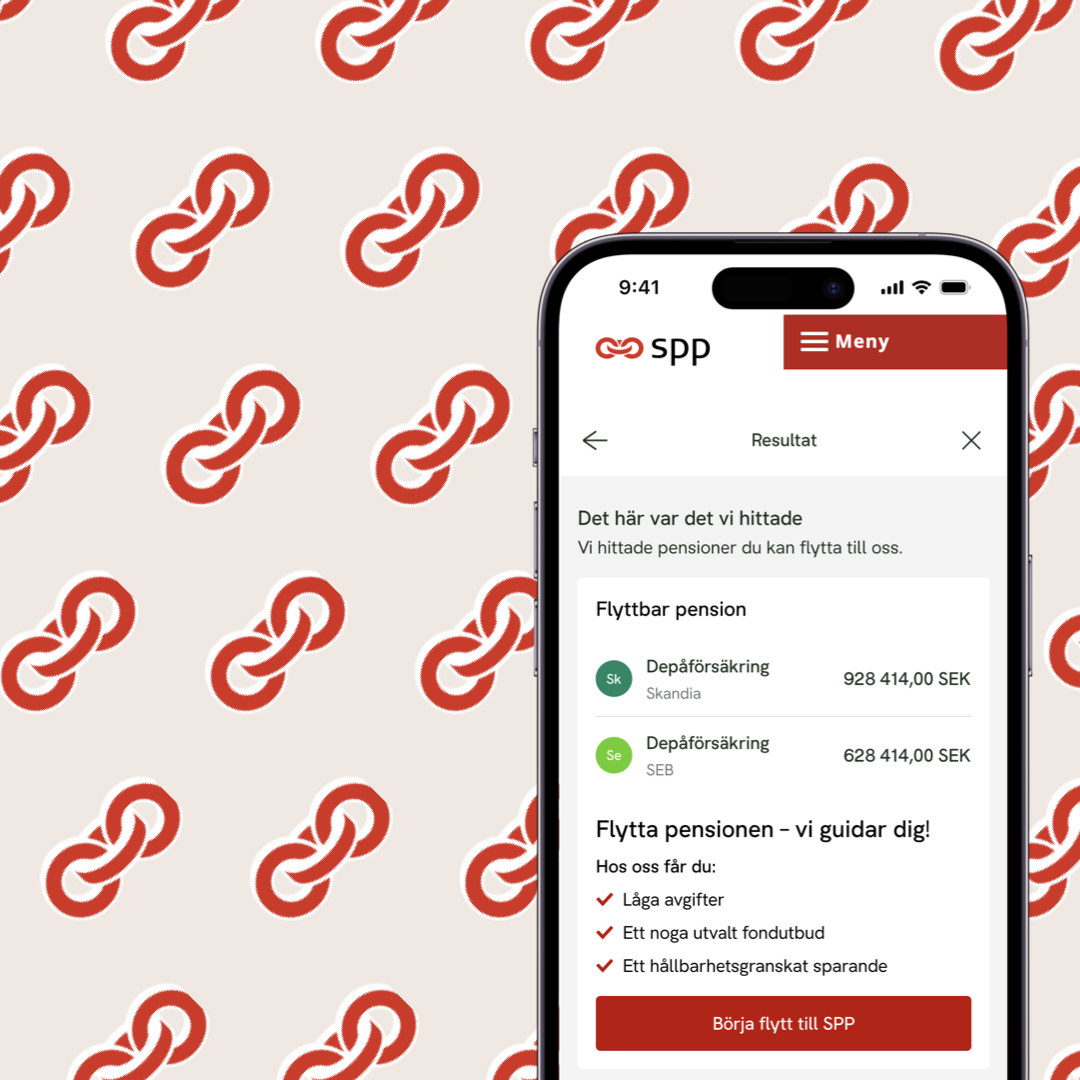

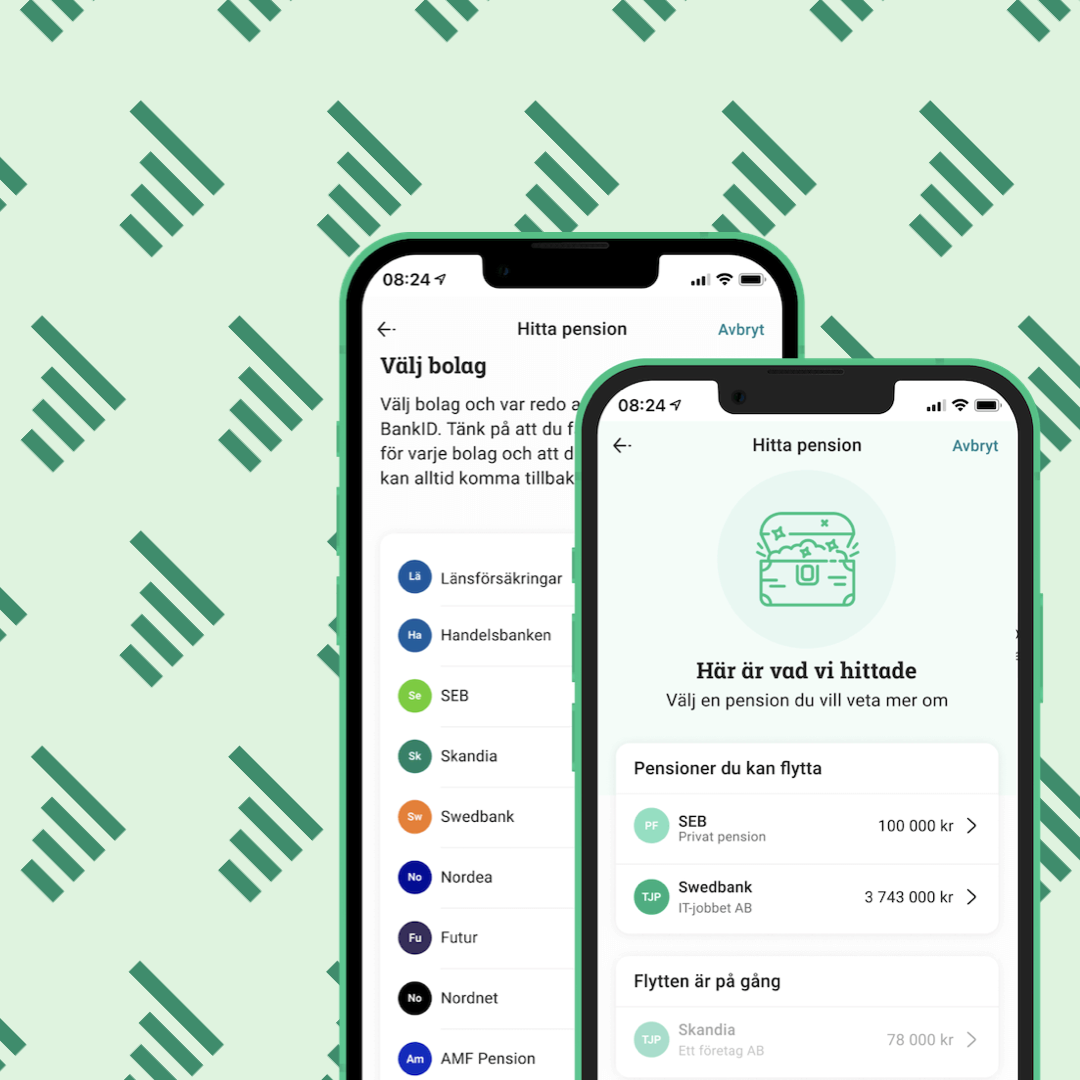

Built with Pension Data Access.

Why real-time pension data?

-

Increase your Assets under Management

By making it easier than ever for customers to move their savings to you, more people will take action, resulting in growth in your assets under management.

-

Increase advisor capacity and quality

By looking at the customer’s own data, advisors instantly see what actions your customers can take to improve their financial future, which results in better advice.

-

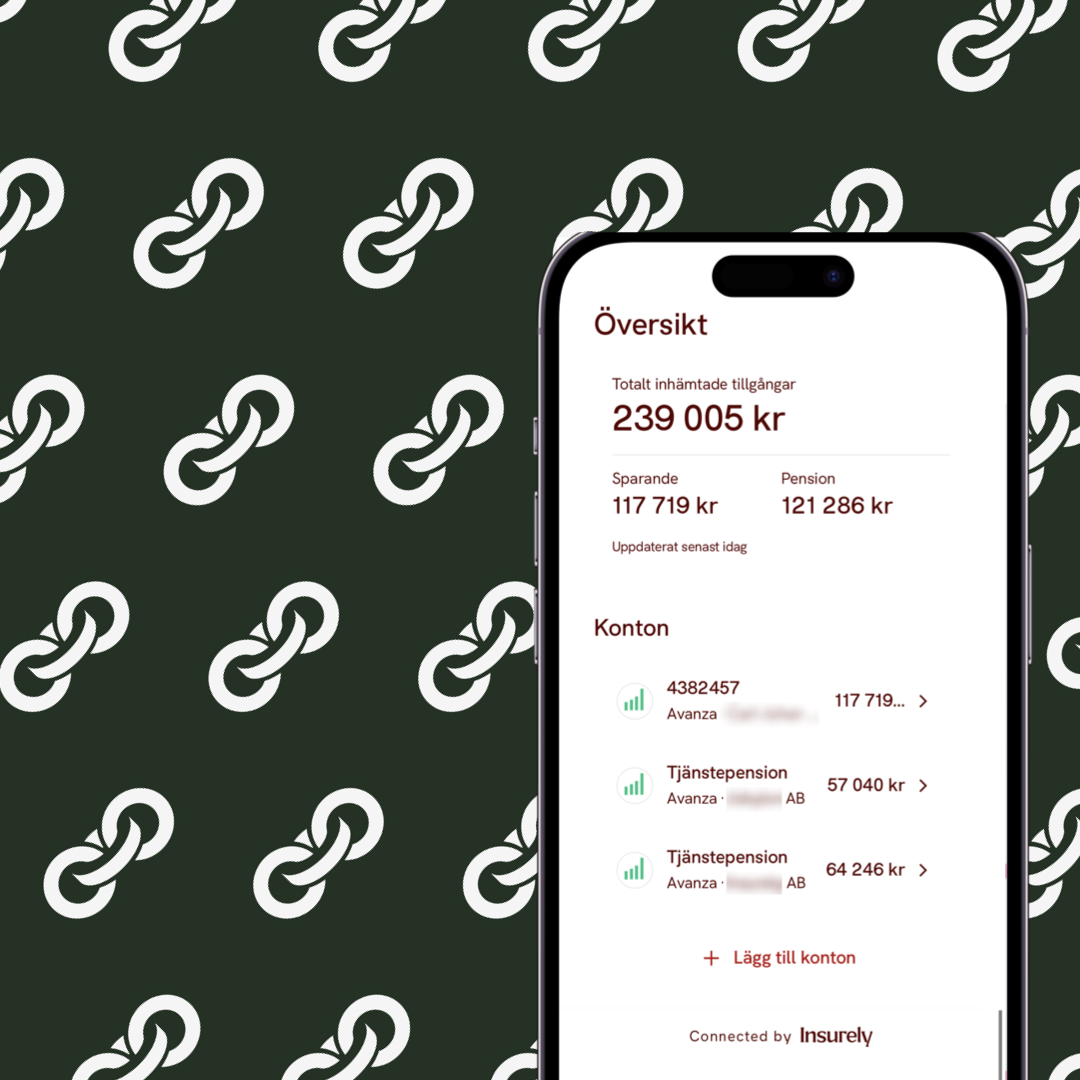

Improve your retention

Become the one place to go for all things pension by helping your customers collect, view, and understand their savings and investments from different sources in one place.

Built with Investment Data Access.

Built with Insurance Data Access.

Why real-time insurance data?

-

Increase sales efficiency

Generate more revenue from your online and offline distribution by leveraging customer data across all channels.

-

Retain and upsell

Engage and retain your customers for longer by creating personalized offers based on customers’ own insurance data.

-

Strategic benefits

Get deep insights into your customer base, market, and competitor products and pricing by allowing customers to collect and share their insurance data with you.