"The market is ready." Direct Assurance & Insurely: A partnership built on customer centric innovation.

Direct Assurance has always embraced forward-thinking solutions, and its early investment in open finance is a clear example of the commitment to innovation. As one of the first movers in France, Direct’s decision to partner with Insurely, positioned them at the forefront of the open finance transformation. The partnership is driven by a shared belief in transparency, accessibility, and customer empowerment—values that resonate strongly in today’s market.

When asked about the reason for investing early in open finance, Mathias Schvallinger, Head of Marketing Analytics and Products, from Direct Assurance explained:

"We discussed the pros and cons, but in the end, testing new innovations is what we do; it's in our DNA as a digital-first company."

When asked about Direct’s journey in adopting open finance and the initial challenges faced, Mathias reflected, “At first, it was challenging to explain our new offering, and perhaps the market wasn’t quite ready. However, since we started a year ago, the market has grown more receptive and we see a lot of potential going forward that we want to explore.”

A partnership built on customer-centric innovation.

Direct Assurance’s collaboration with Insurely is grounded in the idea that seamless, transparent access to insurance data will empower customers to make informed decisions. Through Insurely’s Insurance Data Access, customers can view real-time insurance contract information almost instantly, empowering them to make informed decisions based on their data. Direct Assurance’s decision to integrate open finance technology has been a significant step in modernizing the customer experience, making insurance more transparent, accessible, and trustworthy.

Direct’s focus is to optimize their digital customer journey, both in terms of simplicity to get a quote and simultaneously make it as qualitative as speaking to one of their advisors. By integrating Insurely’s Insurance Data Access, Direct Assurance has simplified the customer journey and elevated service quality.

The solution in practice.

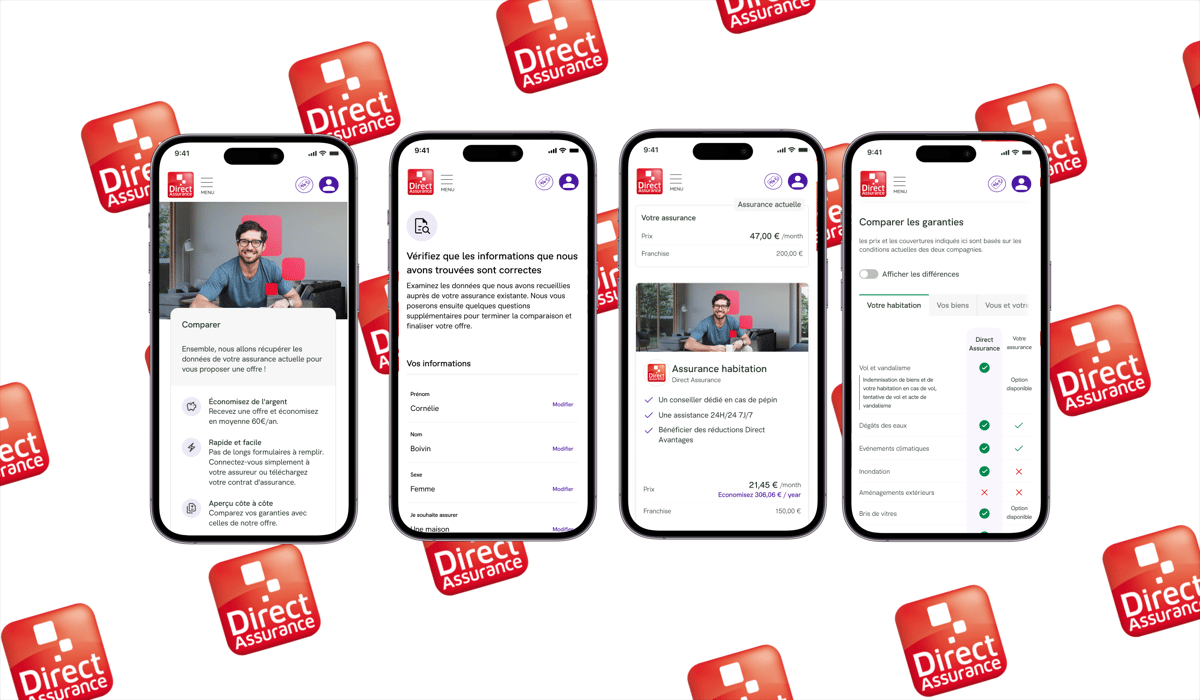

Using Pre-built user interfaces, Direct Assurance was able to quickly integrate the new features seamlessly within their own environment, with minimal development resources. The service allows customers to pre-fill the quoting journey based on the collected data, make informed choices based on a transparent comparison on price and coverage, and onboard seamlessly.

“The collaboration with Insurely is going very well, we work agile with meetings with the project team every week. It was easy to understand how to implement their Pre-built user interfaces and we got instant support for challenges along the way during the whole project.” said Clement Eap, Product Manager Home and Health.

Through this partnership, Direct Assurance can not only track growth and adoption in real time but also analyze user behaviors across the journey via customized Integrated insights dashboard. This insight enables them to refine and optimize their service.

“It’s key for us to have the analytics dashboard, to understand performance and how our customers engage with the service,” said Mathias. “It’s very helpful for making improvements and building analyses to compare users who engage with the service against those who don’t.”

With Insurely’s solutions, Direct Assurance is now leading the way in providing a transparent, personalized insurance experience. Consequently, building stronger, trust-based relationships and seeing a positive impact on KPIs.

We see a clear link between the enhanced customer experience, their knowledge, and our business objectives,” Mathias observed. “We were pleasantly surprised by the adoption rate, and in our strategy, we always look for new technology and solutions to improve our KPIs. Insurely is giving an answer to all this.”

Direct Assurance’s story illustrates the power of open finance to drive innovation, enhance customer relationships, and achieve measurable business goals.

To see how Insurely can help your company become a first mover, book a demo.