01. Insurer selection

The user enters the data collection flow in your app or on your website. The first step the user takes is to select their current insurance provider.

.png?width=477&height=480&name=Frame%2045249%20(1).png)

Improve your sales, retention, and insights by getting real-time insurance data directly from consumers' current policies.

.png?width=1080&height=320&name=Alvsborg%20(1).png)

The user enters the data collection flow in your app or on your website. The first step the user takes is to select their current insurance provider.

.png?width=477&height=480&name=Frame%2045249%20(1).png)

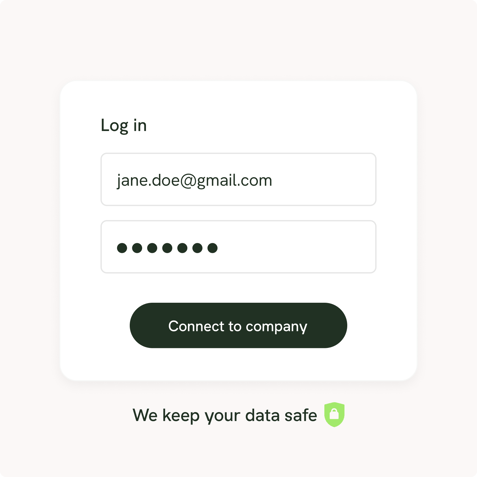

The user then authenticates themselves towards their current insurance provider using single sign on, username and password, or by uploading their insurance contract. At the same time, they give consent to Insurely to collect data on their behalf.

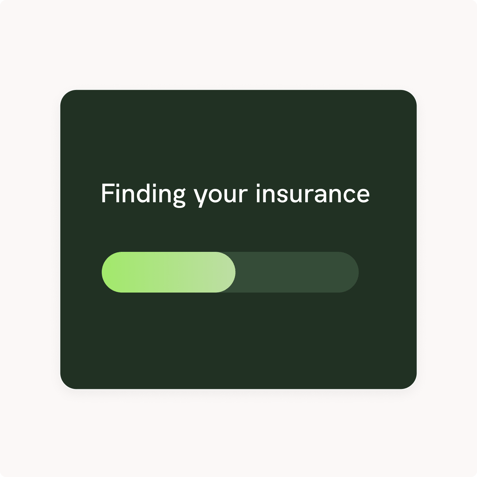

After consent has been obtained, Insurely collects the user’s insurance data on their behalf in real-time. The data is collected, cleaned, standardized and returned to the third party within seconds.

The data can now be used by the third party for a number of different use cases, including increasing sales, retaining customers, and getting strategic insights. It’s also common to display the collected data for the user to help them understand their current coverage.

.png?width=477&height=480&name=Frame%2045258%20(3).png)

Improve your offers and customer experience by using real-time insurance data in your quoting and onboarding flows.

-min.png?width=947&height=1081&name=Img%20(2)-min.png)

Improve the quality of your advisors' calls and meetings by giving them real-time access to consumers’ insurance data.

-min.png?width=947&height=1081&name=Img%20(2)-min.png)

Engage, retain and upsell your customers by offering them an overview of all their insurance policies directly in your app or on your website.

-min.png?width=947&height=1081&name=Img%20(2)-min.png)

Minimize your market risks and develop the right product for the right customer segment by accessing the most reliable insurance and pension data available on the market.

-min.png?width=947&height=1081&name=Img%20(2)-min.png)

Offer a holistic financial experience that is good for your customers and your bottom line.

-min.png?width=947&height=1081&name=Img%20(8)-min.png)

Add new revenue streams by distributing insurance in a bancassurance model that actually works.

-min.png)

Generate more revenue from your online and offline distribution by leveraging customer data across all channels.

Engage and retain your customers for longer by creating personalized offers based on customers’ own insurance data.

Get deep insights into your customer base, market, and competitor products and pricing by allowing customers to collect and share their insurance data with you.

“Insurely helps us collect the right information without effort from our customers, enabling us to deliver a unique and relevant offer both in terms of coverage and price. This is exactly in line with our ambition of being an innovative company, which gives us a competitive edge.”

.png)

Insurance Data Access is currently available in Sweden, Denmark, Estonia, France, and Spain. We are continuously expanding our services, so please contact us if you have questions about our market coverage.

Data points processed daily.

The total amount of insurance policies and pension plans that have been collected and shared through Insurely in the past 6 months.

Advanced technology, with exceptional market coverage and data security, and years of experience at your tech team's disposal.

-min.png)

Insurance Data Access provides you the ability to collect and use insurance data directly from your customers’ current insurance policies in real-time. This data can then be used for a number of different use cases. To use the data for your use cases, you can access the collected insurance data through a few different data access methods, including APIs, our pre-built user interfaces, and through Advisor acess.

Visit our documentation to get more details about how Insurance Data Access works from a technical perspective or contact us.