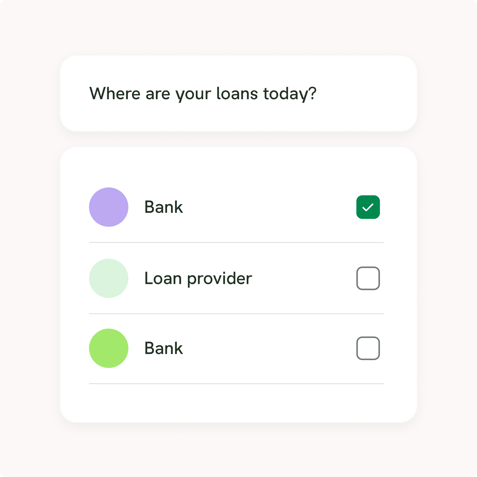

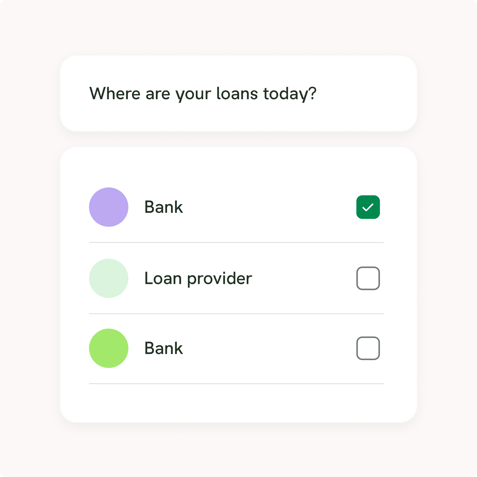

01. Loan provider selection.

The user enters the flow in your app or on your website and selects the loan providers such as banks and loan brokers, they want to collect their loans data from.

Access interest, repayment schedule and loan conditions from a customers unsecured loans data in real-time and make smarter lending decisions.

The user enters the flow in your app or on your website and selects the loan providers such as banks and loan brokers, they want to collect their loans data from.

The user then authenticates themselves towards their current loan provider using BankID. At the same time, they give consent to you to collect data on their behalf.

After consent has been obtained, Insurely collects the user’s unsecured loans data on their behalf in real-time. The data is collected, cleaned, standardized and returned to you within seconds.

.png?width=477&height=480&name=Frame%2045267%20(1).png)

The data can now be used by you for a number of different use cases, such as streamlined customer applications and onboarding with pre-fill information on forms, easier comparison and switching.

Allow customers to auto-fill and digitally retrieve their own loans data, reducing barriers. Resulting in reduced errors and faster approval times.

By looking at the customer’s own loan data, advisors are able to instantly see all the loan details such as interest rate, payments and other loan conditions, resulting in better advice and quicker loan approval time.

Leverage historical and real-time loan data to enhance underwriting. With accurate data the first time around, save time throughout the process and identify relevant users, streamlining credit checks and minimizing expenses.

Data points processed daily.

Data collections done.

Advanced technology, with exceptional market coverage and data security, and years of experience at your tech team's disposal.

-min.png)

Loans Data Access provides you the ability to collect and use loans data directly from your customers’ current loans providers in real-time. This data can then be used for a number of different use cases. To use the data for your use cases, you can access the collected loans data through a few different data access methods, including APIs, our pre-built user interfaces, and through Advisor Dashboard.

Visit our documentation to get more details about how Loans Data Access works from a technical perspective or contact us.